Balance Sheet Example Template Format Analysis Explanation

Balance Sheet Example Template Format Analysis Explanation

January 11, 2023 Comments Off on Balance Sheet Example Template Format Analysis Explanation

Ratios like the current ratio are used to identify how leveraged a company is based on its current resources and current obligations. The financial statement only captures the financial position of a company on a specific day. Looking at a single balance sheet by itself may make it difficult to extract whether a company is performing well. For example, imagine a company reports $1,000,000 of cash on hand at the end of the month.

Example 3: Analyzing Asset Utilization with Asset Turnover Ratio

Familiarity with your balance sheet will give you an under-the-hood look at company finances. Accounts should learn how to analyze a balance sheet for the most insight. Thankfully, you can plug balance sheet information into various ratios for financial ratio analysis.

Assessing balance sheets for growth

Public companies are required to have a periodic financial statement available to the public. On the other hand, private companies do not need to appeal to shareholders. That is why there is no need to have their financial statements published to the public. It is important to understand that balance sheets only provide a snapshot of the financial position of a company at a specific point in time.

Report format:

Different industries, and therefore different companies, may have slight variations in reporting standards. Looking under the surface of these figures lets analysts and investors see how the business is doing financially, and compare one company to another. Employees usually prefer knowing their jobs are secure and that the company they are working for is in good health.

Liabilities are listed at the top of the balance sheet because, in case of bankruptcy, they are paid back first before any other funds are given out. Yes, the balance sheet will always balance since the entry for shareholders’ equity will always be the remainder or difference between a company’s total assets and its total liabilities. If a company’s assets are worth more than its liabilities, the result is positive net equity. If liabilities are larger than total net assets, then shareholders’ equity will be negative. Current liabilities are the company’s liabilities that will come due, or must be paid, within one year. Within each section, the assets and liabilities sections of the balance sheet are organized by how current the account is.

Updates to your enrollment status will be shown on your account page. HBS Online does not use race, gender, ethnicity, or any protected class as criteria for enrollment for any HBS Online program. Finally, unless he improves his debt-to-equity ratio, Bill’s brother Garth is the only person who will ever invest in his business. The situation could be improved considerably if Bill reduced his $13,000 owner’s draw.

- First, the fixed asset turnover ratio (FAT) shows how much revenue a company’s total assets generate.

- So, while they can’t explain commercial trends, you can compare balance sheets to measure growth over time.

- The color formatting abides by general financial modeling best practices, which make building a financial model easier for the one creating the model and for purposes of auditing.

- We can add context to this number by calculating the percentage change during the period.

- After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

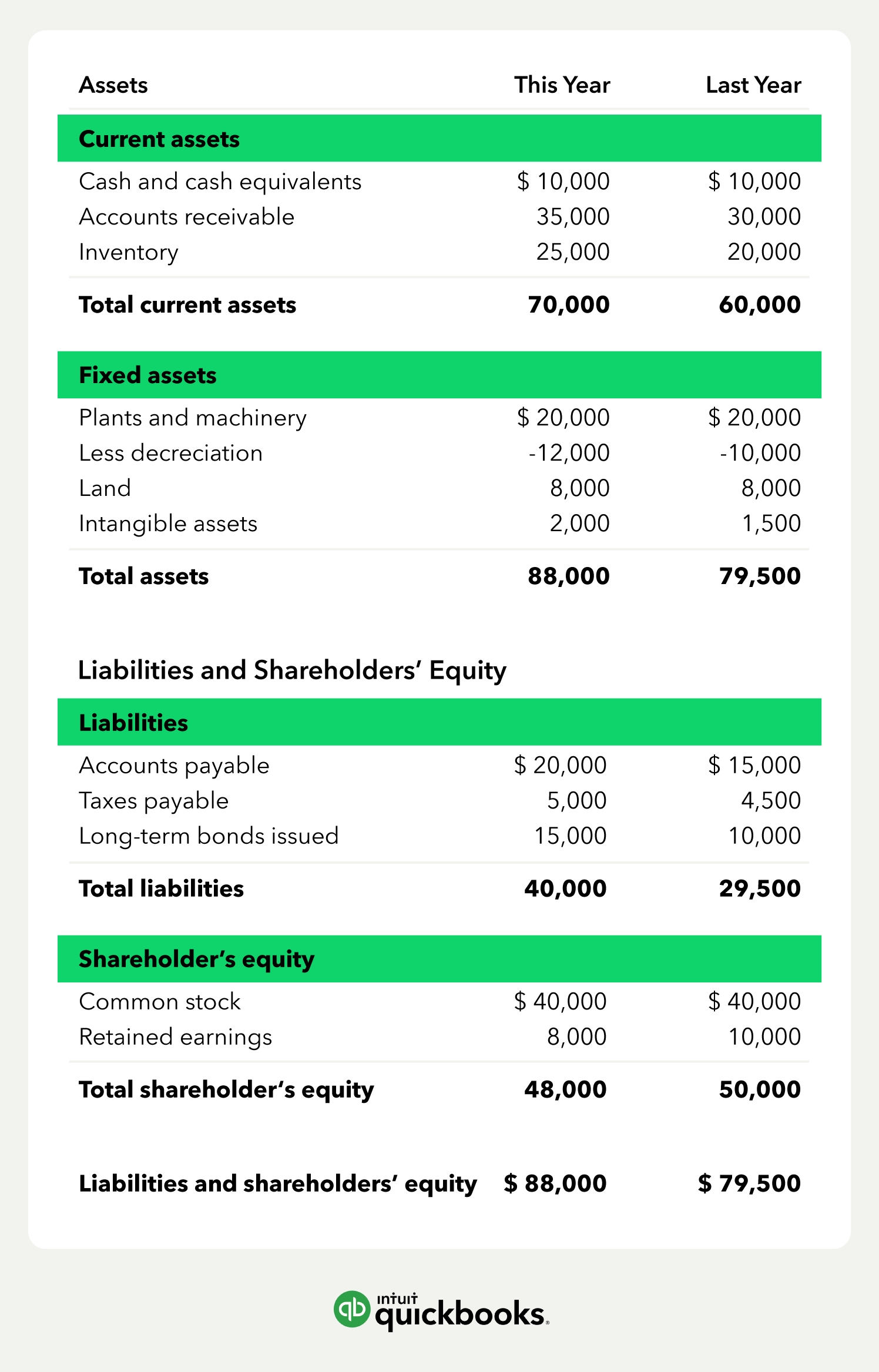

A balance sheet is also always in balance, where the value of the assets equals the combined value of the liabilities and shareholders’ equity. Looking for an even simpler way to create balance sheets that support your business? FreshBooks’ free balance sheet template will help you keep track of all the information you need to manage your numbers with ease, helping you to check balances and keep your finances in order. In report format, the balance sheet elements are presented vertically, i.e., the assets section is presented at the top, and the liabilities and owners equity sections are presented below the assets section.

If this balance sheet were from a US company, it would adhere to Generally Accepted Accounting Principles (GAAP). Current and non-current assets should both be subtotaled, and then totaled together. This may refer to payroll expenses, rent and utility payments, debt payments, money owed to suppliers, taxes, or bonds payable. An asset is anything a company owns which holds some amount of quantifiable value, meaning that it could be liquidated and turned to cash.

Long-term liabilities, on the other hand, are due at any point after one year. Publicly held companies are required to file quarterly reports with the Securities and Exchange Commission. You can access these reports through a company’s investor relations section on its website, or via the SEC EDGAR database. You can also listen to the company’s quarterly earnings calls to hear company executives’ views of current business conditions. The owners’ equity section may also show dividends paid to owners or shareholders during the year. Retained earnings is the sum of all the years of net income the company has earned over time, over and above dividends it has paid out.

Below liabilities on the balance sheet is equity, or the amount owed to the owners of the company. Since they own the company, this amount is intuitively based on the accounting equation—whatever assets are left over after the liabilities have been accounted for must be owned by the owners, by equity. These are listed retained earnings: entries and statements financial accounting at the bottom of the balance sheet because the owners are paid back after all liabilities have been paid. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. With liabilities, this is obvious—you owe loans to a bank, or repayment of bonds to holders of debt.