British Repaired-rates Mortgages against. United states Fixed-speed Mortgage loans

British Repaired-rates Mortgages against. United states Fixed-speed Mortgage loans

February 12, 2025 Comments Off on British Repaired-rates Mortgages against. United states Fixed-speed Mortgage loansAccording to the Financial from The united kingdomt, over 50 % of mortgage loans you to originated Q4 from 2019 got 5-season repaired rates of interest otherwise longer. Towards , the typical price getting an effective 5-seasons repaired home loan is actually 2.69%, while you are an enthusiastic SVR had the common rates out of four.41%. That’s an impact of 1.72%. For this reason, extremely homeowners are inclined to grab repaired-speed mortgage loans.

When taking a fixed-rates home loan, your price remains the exact same towards first 2, twenty-three, or 5 years of financing

United kingdom mortgage loans generally amortize to possess twenty five years. Other people can even need provided ten years. Already, the most popular repaired-rate label is the 5-season option.

Small a couple of-12 months terms and conditions always have a decreased costs. Nevertheless they dont promote secure money for a longer period. For folks who remain bringing short, fixed-speed business, you should remortgage more often. This is a pricey and day-sipping techniques. If the financial cost boost immediately after 36 months, you might get a higher rate even though you secure a predetermined-speed loan.

At the same time, 5 to ten-year fixed terms and conditions has slightly highest costs than just small, fixed words. However, while the a plus, you get longer payment balance, that is a trade-from for many homebuyers. You don’t need to to remortgage all couple of years. In the event the pricing boost, you will be going to improve exact same repayments during the home loan identity. At the same time, if the interest rates ultimately drop off, you simply can’t make use of cheaper mortgage repayments. You should make the same payment per month for the 5 or 10-season term.

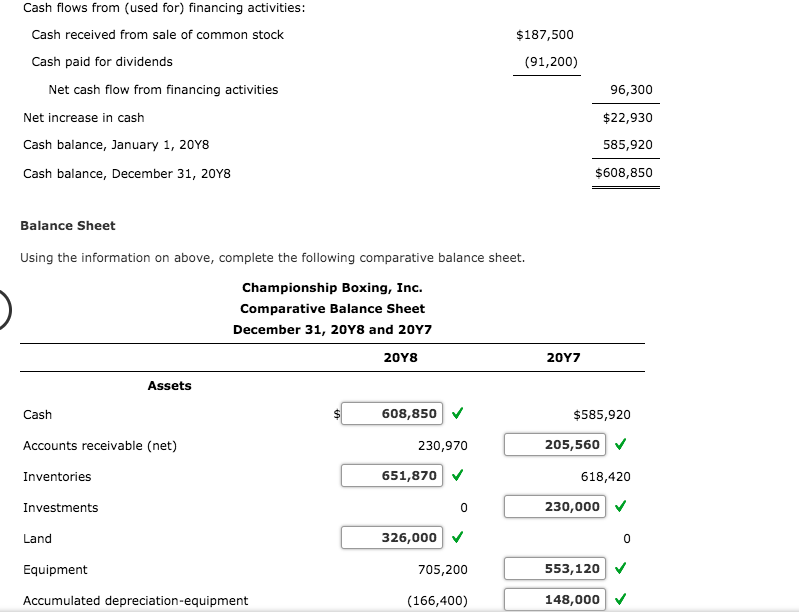

Evaluate home loan cost between SVR mortgages as well as other fixed-speed terms and conditions, consider the fresh desk less than. The following table suggests mediocre cost to own United kingdom mortgage loans since .

The brand new dining table suggests that the highest mortgage speed is the SVR at the 4.41%. See how fixed pricing boost because the name try expanded. The two-12 months repaired label has the low rates at the 2.49%, because large price ‘s the 10-year fixed name in the 2.85%.

Just as the United kingdom, most homebuyers in the us plus favor fixed-rate mortgages. The latest foreseeable payments cause them to more attractive options for individuals. pop over to this site Although not, instead of United kingdom mortgage loans, fixed-price mortgage loans in the us markets are still repaired for the whole lifetime of the mortgage. That it generally speaking can last for 3 decades. While you are a fixed-home loan in the uk are only able to last for 2 to help you 10 age, a fixed home loan in the usa are closed to your full 30-seasons title. In the event the All of us consumers need to changes its rates and identity, they have to remortgage its mortgage, which is sometimes called refinancing in america housing marketplace.

Meanwhile, in the uk, youre required in order to remortgage your residence loan every few age, based your favorite term. If you do not, your own financial reverts on the a standard variable rates mortgage (SVR) just after a fixed-speed home loan. This can cause volatile payments one alter with regards to the Lender off The united kingdomt foot rate, and lender’s rate conditions.

Before the repaired mortgage changes so you’re able to a keen SVR, you can remortgage on the an alternative fixed price name, otherwise choose almost every other home loan alternatives that helps increase the offers. Remortgaging allows home owners to help you secure a decreased price with a brand new home loan identity to quit the higher SVR rates. It remortgaging techniques are going to be regular by the borrower until its left equilibrium was reduced inside the twenty-five-12 months identity.

Part of the Elements of Mortgage repayments

- Investment the borrowed funds matter, which is how much you borrowed from

- Rate of interest based on the apr (APR)

- Mortgage identity the latest agreed payment years in years and number of payments