Credit score from 580: Just what it Opportinity for Money & Playing cards

Credit score from 580: Just what it Opportinity for Money & Playing cards

December 28, 2024 Comments Off on Credit score from 580: Just what it Opportinity for Money & Playing cardsWhat does a credit score out-of 580 imply? Is a credit score of 580 an excellent or bad loan places Towaoc?

A credit rating from 580 is known as Poor. In reality, one credit rating below 619 can really bring a toll on somebody’s lives and never in a great way. The effects shall be even worse than just one to might imagine.

In this article, we’re going to express what with a credit score of 580 way for home loans, car loans and handmade cards. Together with, we’re going to display simple tips to improve an effective 580 credit history.

Credit rating away from 580: Auto loans

To find a car or truck that have a credit score of 580 is achievable, however, highest interest levels are often provided to people with bad credit. What’s the rate of interest getting a credit history regarding 580 into the an auto loan?

Earliest, why don’t we make average amount borrowed because of the vehicles buyers: $twenty seven,000 based on Melinda Zabritski, Experian’s senior manager out of motor vehicle borrowing. Now, let us cause for the 3 well-known brand of automobile financing available to help you you within the myFICO’s loan discounts calculator: 36-month the car loan, 48-day the auto loan and a good sixty-few days the latest car loan.

Let’s consider simply how much a great deal more an automobile will cost you for somebody that have a credit history out of 580 compared to the a good credit history regarding 680.

Can be a credit history of 580 get a car loan? Given that graph above shows, getting a car loan which have a 580 credit score goes so you can ask you for far more. To the a beneficial thirty six times the new car finance, it will cost $3,734 alot more. Towards the a forty-eight few days, $5,096 even more. Into the a good sixty times car loan, you will be charged you an impressive $6,506 a whole lot more.

This means that, should your obtained changed to good 680 using credit repair, you might help save several thousand dollars in your mortgage. Not envision it’s really worth a few hundred bucks to change your borrowing from the bank before taking a test drive? Contact Wade Brush Credit to begin with.

Credit rating regarding 580: Handmade cards

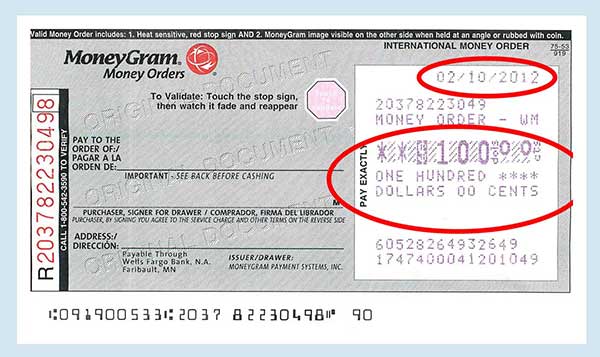

The entire advice that have credit cards would be the fact any score more than 600 will get be eligible for an unsecured credit. For those who have a credit score of 580, then you will just be eligible for a secured charge card and you may are required while making the very least deposit so you’re able to discover your bank card. Wade Brush Borrowing constantly evaluates borrowing from the bank products and you may already advises this type of Secured Notes for people with a credit score from 580.

We have seen to a beneficial forty point boost in credit score by beginning one of these cards. What are the results into the Apr having a credit score off 580? Here’s a chart showing the differences ranging from annual charges and you may notice prices between anybody having good credit and you will a credit rating out of 580.

Credit history regarding 580: Mortgage brokers

Imagine if youre an initial time domestic customer that have good credit score from 580. Can be a credit history out of 580 get a house?

For almost all mortgage loans you need to be more than a beneficial 620 borrowing from the bank score, however, you can find financing online which go down so you can 580 getting FHA. Then again other details score much harder (lives loans so you can money) this will make it fairly difficult to qualify less than 620.

What if that you may be eligible for a FHA mortgage with a credit history out-of 580, however, while we are able to see from the maps lower than, a low FICO score increases the sum of money might wind up spending on a loan on the course of their life. When your FICO get is lower than a 560, very lenders does not actually consider giving you a great jumbo financing for a good FICO rating you to definitely low.

Note: New 29-seasons repaired jumbo home loan APR’s are estimated in accordance with the following the assumptions. Credit scores ranging from 620 and you can 850 (five hundred and you can 619) guess a loan amount out of $3 hundred,000, step 1.0 (0.0) Factors, just one Family Holder Filled Property Type and an 80% (60-80%) Loan-To-Well worth Ratio.

Thus normally a credit history out of 580 get a mortgage? Possibly. However, delivering a home loan having a credit history out of 580 often include an additional $68,040 throughout the loan than just some body having good 721 credit history. The interest rate having a credit rating away from 580 will increase the newest monthly mortgage repayment by $222 more than individuals that have a get 95 items high, during the a credit score regarding 675.

Just how to Boost A credit history off 580

Exactly how crappy try a credit score out-of 580? Due to the fact there is noticed in this new sections more than, this score impacts every aspect of debt life. Mortgage loans, auto loans and credit card rates of interest are substantially large than just they might become if you had moderate borrowing.

If you’d like to alter your credit score regarding 580, there are numerous methods go about it.

1) Look at this blog post on precisely how to Change your Credit score Within a month. We list easy resources within this article instance paying rotating balances in order to less than 31% or any other resources which can replace your rating easily.

2) Check this out post about what Never to would when restoring borrowing from the bank. The last thing you should do try circulate backwards for the your efforts adjust your own borrowing problem.

3) For those who surely must improve your credit rating inside 29 weeks, you are going to work with because of the hiring the help of a card repair organization such Wade Clean Borrowing. To learn more about all of our credit repair apps, please e mail us.

Long lasting your position, Go Brush Credit enjoys a solution. I’ve of many borrowing from the bank resolve applications that are available to assist you beat the borrowing from the bank condition and place you right back to the way to monetary triumph. Genuine borrowing restoration is not a good after proportions suits every model and we tailor your position on the right program, but the majority somebody can begin just for $99 four weeks.

I’ve fixed rate applications which get your back focused within 5 weeks, obligations quality choice, programs aimed toward people who have got previous small conversion process or foreclosures and many more. Help is just a free of charge call away you can also fill out an appointment demand. Get in touch with Go Brush Borrowing so you can agenda a no cost visit now.