eight. Follow-up that have lenders and system administrators

eight. Follow-up that have lenders and system administrators

February 6, 2025 Comments Off on eight. Follow-up that have lenders and system administratorsIf you find yourself a primary-date domestic consumer with reduced so you can moderate earnings, you happen to be qualified to receive help from charitable otherwise nonprofit organizations. Such agencies aren’t governmental but render rewarding informative and you will financial info so you’re able to navigate very first-day family client mortgage requirements when purchasing very first home.

An alternative nonprofit readily available along the You.S. is the People Advice Corporation off The united states (NACA). Providing to help you family that have economic instability, NACA provides home loan guidance and you will training. It come together that have loan providers that are ready to fit lower-earnings parents for the securing the first-mortgage.

Just what kits NACA aside would be the fact their financing type will not require a down payment, closing expenditures, if not a base credit rating, providing prospective homeowners a customized method of fulfilling very first-date family client financing criteria.

Environment getting Mankind

Habitat to own Humanity try an internationally acknowledged nonprofit worried about offering adequate, straightforward, and value-effective residential property having family having limited income. It participate volunteers to construct property, making certain that the total pricing stays less than other field solutions post-closure. Very, for people who satisfy their criteria and first-big date house customer mortgage standards, this can be a method to look at to get more reasonable homes.

Like many authoritative initiatives, a lot of charity entities and nonprofits are nearby. New You.S. Agencies from Property and you will Urban Creativity (HUD) preserves a continuing set of approved nonprofit groups found in all the condition and you may state. To explore local property applications that may help you refinance otherwise purchase a home in this five years, it is possible to check out HUD’s web site.

Because the an initial-date house visitors, creating bucks with the deposit and you may settlement costs is amongst the most significant difficulties.

Once you meet the first-date household consumer financing requirements into the program you have in mind, it is time to begin the loan procedure. Making an application for home financing will be a straightforward procedure in the event that guess what measures when deciding to take. Is one step-by-step help guide to help you browse the application processes and you will improve your odds of taking acknowledged.

Prior to beginning the applying process, be sure to meet with the basic-day household buyer mortgage conditions for the system you are interested in. This generally concerns examining your credit score, earnings, employment background, and you will confirming you meet the concept of an initial-time house customer.

2. Research available software

Mention different earliest-day family buyer software offered by the brand new federal, state, and you will local profile. Envision different varieties of funds and you can direction programs, particularly FHA, Va, USDA loans, or any other authorities-supported and you may nonprofit applications.

step 3. Assemble expected records

- Evidence of income (pay stubs, W-2s, taxation statements)

- A position confirmation

- Credit reports

- Financial statements

- Identification data (age.g., driver’s license, Social Security card)

- Files of any other property or liabilities

4. Rating pre-accepted for a mortgage

Before you apply to possess certain software, it’s advantageous to score pre-approved to possess a mortgage. This requires dealing with a loan provider to determine how much you can borrow and you can what forms of finance your qualify for. Pre-approval gives you a better comprehension of your finances and strengthens your role when making an offer for the property.

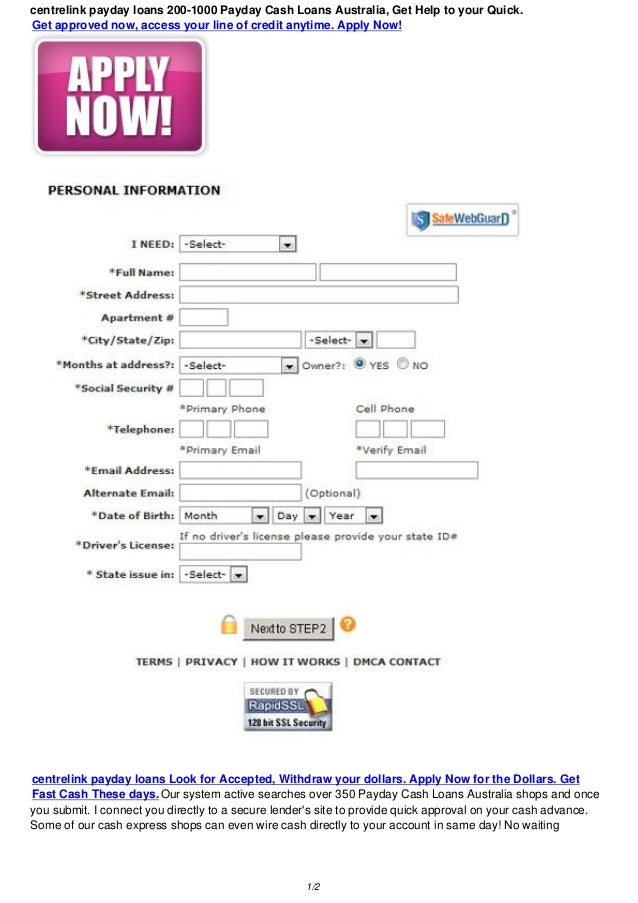

5plete the application models

Complete the program variations on the applications you will be deciding on. Be certain that the data is perfect Albertville loans and you will done. This step could possibly get encompass several apps while you are making an application for each other financing apps and extra direction software.

6. Complete your application

Fill in the finished application forms plus the needed paperwork in order to this new particular program administrators. This might be complete online, by the post, or perhaps in person, with respect to the program’s methods.

After submission your own apps, follow-up with the loan providers and you may system directors to verify receipt and check the status of one’s application. Anticipate to promote a lot more personal funds guidance otherwise paperwork in the event the questioned.