FHA Loan Guidelines to own Second House Sales

FHA Loan Guidelines to own Second House Sales

February 12, 2025 Comments Off on FHA Loan Guidelines to own Second House SalesThe simple truth is that FHA financing rules to your single-family loan program are capable of holder-occupiers, however, depending on points a borrower are passed by a great participating financial to buy another home–usually as a result so you can a practical you prefer including more substantial family members or business standards outside a fair travelling distance.

According to FHA loan rulebook, To cease circumvention of limits on the FHA insured mortgages to traders, FHA essentially does not insure several mortgage for any debtor (purchases where a current FHA financial is actually paid and you will a new FHA financial is actually acquired try appropriate).

Anybody in person or jointly home ownership protected by a good home loan insured because of the FHA in which possession was maintained might not purchase a different sort of principal quarters having FHA home loan insurance rates but under the things revealed less than.

One to info is used in HUD 4155.1 Part Four Part B–the new old kind of the fresh new FHA Single Family members Mortgage rules likely to be replaced inside the because of the a new frequency known as HUD 4000.one. Until or till the FHA revises the fresh effective on the go out on the the fresh rulebook, HUD 4155.one continues to be the product quality. Exactly what are the conditions said in the HUD 4155.1 Chapter Five?

A person is taken to relocations. Should your debtor is actually moving in and you can lso are-creating residency an additional city not in this practical commuting point from the modern prominent household, the fresh new borrower get see another mortgage using FHA covered resource and you will is not required to sell the current property covered by a keen FHA covered mortgage.

The newest FHA describes which exception to this rule after that, claiming, The newest moving doesn’t have to be company mandated to help you be eligible for that it exemption. Then, if your debtor returns so you can an area where they owns a property which have an enthusiastic FHA covered mortgage, that isn’t required that the latest debtor lso are-establish no. 1 residence in that property to be eligible for another FHA covered mortgage.

Other causes a different ily size, otherwise a debtor who is vacating a jointly owned possessions. In all issues one to meet the requirements, the application on the the newest FHA mortgage was processed to the a good case-by-situation foundation, therefore a debtor should work on their particular playing FHA bank observe what exactly is you can. You’ll find nothing wrong having powering your circumstances prior financing officer observe what one lender might possibly be prepared to do.

Relevant Home loan Content

When you’re refinancing during the first five years is almost certainly not fundamentally recommended, discover scenarios where it could make sense. Including, when the nice home improvements possess notably improved your home value, you could have enough security to help you validate an excellent re-finance.

The newest debtor having a father expenses education loan financial obligation every times may be able to inform you the money income from you to fee is secure and you will reputable. Obligations placed in her term can also be and probably would be included in financial obligation-to-money proportion calculations.

The latest FHA Improve Re-finance try a program rendering it smoother if you have established FHA funds in order to re-finance. It was built to feel easier and you will less than just a regular refinance, that have shorter records and you can quicker approval times.

FHA money routinely have occupancy requirements, meaning you ought to want to are now living in the home as your primary house. Inside normal cases, you can technically only have an FHA loan for starters number 1 house at a time.

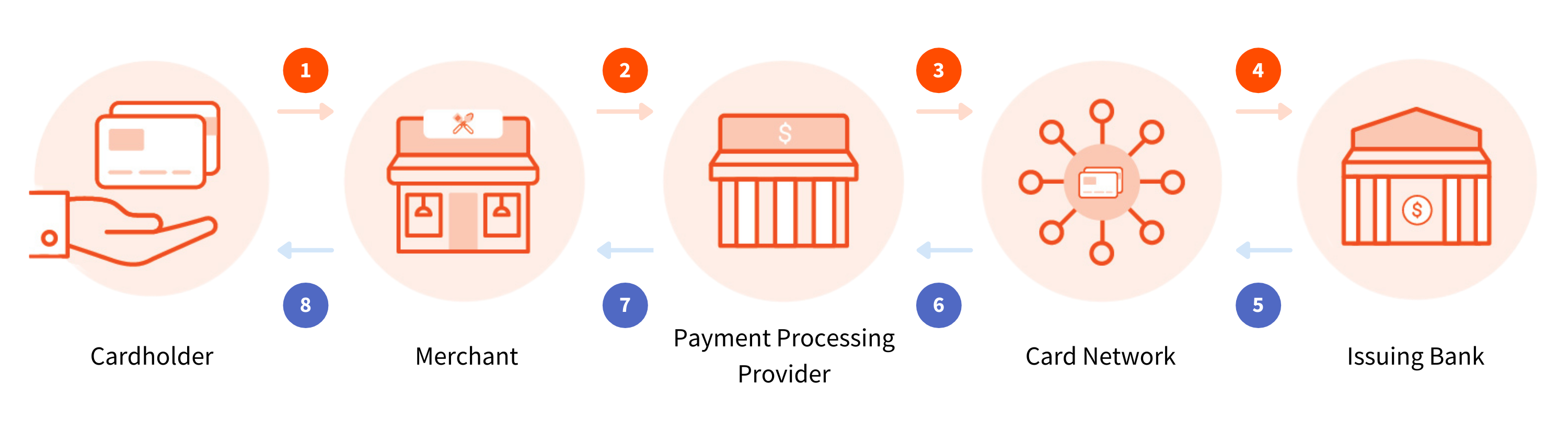

The procedure begins whenever a prospective buyer finds out a home and you will produces a deal towards seller. In case your offer is suitable, the customer work that have an enthusiastic FHA-recognized financial so you’re able to begin the mortgage application processes.

Why is it a good idea to create a more impressive off commission on your own FHA mortgage as compared to minimum? There are a number of powerful reasons, along with a reduced dominant equilibrium. Just what are a few of the most other reasons to expend even more in advance for the a home loan?

Relevant Financial Terminology

The fresh Government Construction Administration, or perhaps the FHA, was a national-work at agency that provides insurance rates into the FHA-recognized mortgage loans, so you’re able to increase reasonable housing on You.S.

FHA funds try insured of the government so you can assist help the method of getting reasonable casing on the You.S. These fund was backed by the brand new FHA, which protects loan providers off significant loss.

The brand new HUD try an authorities company that really works to boost reasonable property of the implementing software and formula you to activate the genuine property market.

The borrowed funds officer works at loan company where you’ve used to have a mortgage. They are guilty of matching home financing system for the demands and you may handling your loan software.

When looking for another home, many people get a home loan to fund it. That is financing which allows you to definitely borrow money in order to purchase the property, and then make monthly obligations to settle your debt with attract.

The borrowed funds equilibrium is exactly what your since a borrower have remaining to invest to the mortgage prominent. Excluding focus, here is the matter you borrowed to help you pay-off the money borrowed on lender.

Related Inquiries and you may Responses

When you’re going into the FHA loan application procedure and now have started at your work for less than couple of years, you’ve got particular concerns plus particular misconceptions that require fixing. You could potentially need certain a job holes that want describing.

Probably one of the most key factors of getting your credit score in form before you apply to own an enthusiastic FHA real estate loan was time. If you think their borrowing from the bank is actually bad shape, you’ll want to expose percentage accuracy over a period of at minimum 1 year be.

While it’s enticing going it alone and functions individually which have a seller, look at the feel an agent could possibly offer to you personally as the a potential homebuyer. You might control their experience for the a far greater contract for your requirements along with your family members.

Knowledge exacltly what the payment otherwise your rate of interest is is not enough. Inquire about facts about money with the exact same amount borrowed, but with some other financing conditions otherwise loan models and that means you is also compare one pointers.

The newest Federal Casing Government are a company of federal government. The newest FHA provides private money awarded for new and you will present homes, as well americash loans Cimarron Hills as for recognized applications having domestic repairs. The fresh new FHA is made because of the Congress in the 1934, as well as in 1965 became region.

FHA gathers a single-big date In advance Home loan Insurance premium (UFMIP) and an annual premium (MIP) that’s compiled within the monthly obligations. Really FHA financing apps make the UFMIP an importance of the latest financial and permit individuals to invest in.