How come line 8 of the PPP Loan Forgiveness Application form 3508EZ possess me personally separate costs by .sixty?

How come line 8 of the PPP Loan Forgiveness Application form 3508EZ possess me personally separate costs by .sixty?

January 2, 2025 Comments Off on How come line 8 of the PPP Loan Forgiveness Application form 3508EZ possess me personally separate costs by .sixty?The newest PPP Loan Forgiveness Form 3508EZ tips signify new forgiveness count is the shorter of your own after the computations:

SBA and you may Treasury instituted an exclusion excluding laid-away from teams who the fresh debtor available to rehire (for the same paycheck/earnings and you may same number of instances) on CARES Act’s loan forgiveness cures formula

- Payroll and you will Nonpayroll Will cost you

- PPP Amount borrowed

- Complete Payroll Will set you back Separated of the sixty%

In accordance with the PPP Self-reliance Act, no element of that loan might be forgiven if sixty% or more of your stated eligible expenditures are not useful payroll will cost you, especially.

SBA and you can Treasury instituted an exclusion excluding laid-away from staff whom the new borrower available to rehire (for similar paycheck/earnings and you may same level of occasions) regarding CARES Act’s financing forgiveness cures calculation

- Was self-functioning as well as have zero group; Or

- Did not slow down the wages otherwise earnings of the team by more than 25%, and you can don’t reduce the level of era of their team; Otherwise

Educated decrease running a business craft down seriously to wellness directives about COVID-19, and you can failed to slow down the wages or wages of the group by the more twenty five%.

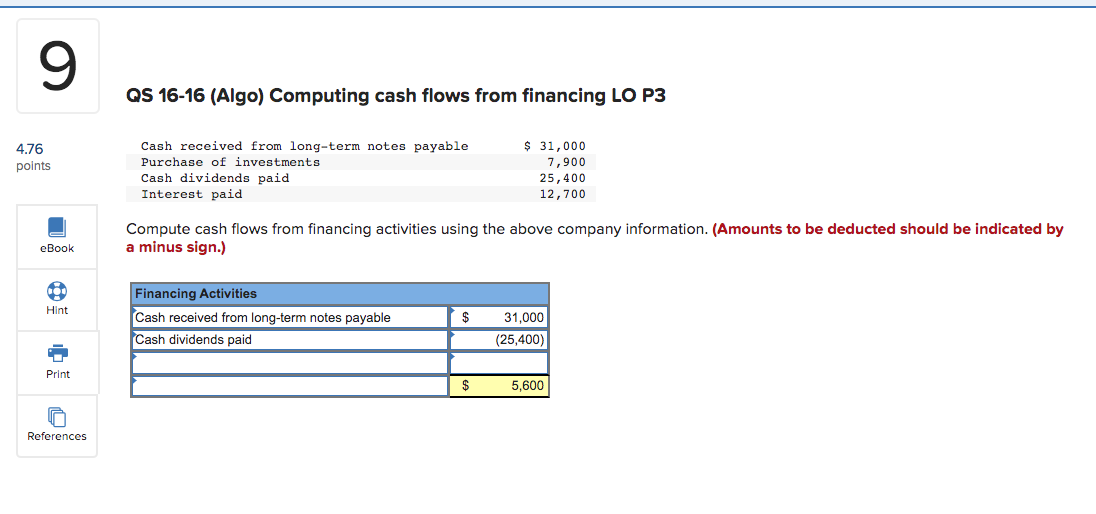

Beneath the PPP Liberty Act finalized into rules on , a debtor are now able to qualify for complete mortgage forgiveness if the 60% or more of the financing forgiveness count went towards the payroll can cost you instead of the 75% in the first place mandated from the CARES Act. Financing forgiveness is based up on the smaller of one’s totally new financing matter, the eligible expenses, or their payroll will set you back also up to 40% eligible nonpayroll costs (which, algebraically, is payroll will cost you split by sixty% otherwise .60).

SBA and you may Treasury instituted an exception excluding laid-out of personnel exactly who the fresh new debtor offered to rehire (for the very same income/earnings and you will same quantity of circumstances) throughout the CARES Act’s loan forgiveness avoidance computation

- $75,000 toward payroll will cost you

- $20,000 to your book

- $5,000 when you look at the mortgage attention.

You invested 60% or even more into the payroll debts so you may have obtained forgiveness for approximately $125,000 for people who separated men and women expenses because of the .60 for every line 7 of one’s form.

However,, you cannot receive forgiveness for more than the initial loan amount Or more than your real costs, so you perform nonetheless merely found forgiveness to possess $100,000.

If that same borrower merely spent $50,000 on payroll costs, he’s only eligible for all in all, $83,333 altogether loan forgiveness. The remaining equilibrium of $100,000 loan would be must be repaid in the a great price of 1%, following a great 10-times deferment of great interest and dominant.

Generally, the alteration allows an individual who just spent $sixty,000 of the brand spanking new $100,000 loan amount to the payroll costs as qualified to receive full loan forgiveness, incase the remaining number can be used for qualified expenditures. Loan forgiveness is also quicker for people who installment loan no credit check Magnolia don’t take care of otherwise restore the FTE (plus don’t has actually a qualified exception to this rule) or if you shorter the latest wages or wages off private team.

SBA and you may Treasury instituted a different leaving out placed-from personnel just who the brand new borrower accessible to rehire (for the same income/earnings and you can exact same level of hours) in the CARES Act’s financing forgiveness reduction computation

- You can not use the the new EZ form if the youreduced the newest wages otherwise wages of your own team because of the over 25%.

What happens to financing forgiveness if the a worker refuses an offer so you’re able to rehire and you can/or perhaps is terminated or resigns?

Documentation are required to help with such exemptions. As well, the new different having an employee whom refused a deal out of rehire just is applicable when the: