Simple tips to make an application for a house guarantee mortgage otherwise HELOC when the you will be self-operating

Simple tips to make an application for a house guarantee mortgage otherwise HELOC when the you will be self-operating

December 14, 2024 Comments Off on Simple tips to make an application for a house guarantee mortgage otherwise HELOC when the you will be self-operatingIn case your mind-work money try varying, you could potentially getting more secure to the independency out-of a HELOC. After you aim for something, comparison shop to own a lender. Its smart to analyze and acquire a loan provider we need to work on. Before you choose a lender, see buyers studies to be sure it does meet your needs.

- Interest rates

- Commission structures

- Processing times

- Financing terminology

- Potential offers

Loan providers could have book approaches for verifying income. Find options that offer measures and shell out stubs and you will W-9 forms and contrast rates of interest. Specific lenders may charge a higher rate to own individuals who will be self-used to help decrease the risk of inconsistent earnings. But it’s perhaps not a guideline across-the-board, so compare the loan estimates to search for the best choice.

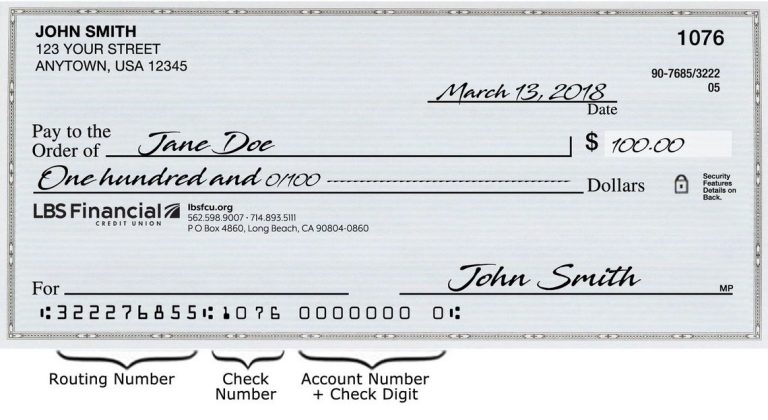

Shortly after buying a loan provider, you can easily gather your details to suit your app. It will has personal and you can economic guidance plus residence’s estimated really worth. Needed financial records range between personal and organization financial statements and you will tax statements.

Then you’ll definitely need your residence appraised (the bank commonly plan that it), and it’ll complete a difficult credit score assessment. Check out our search into the better domestic security fund and you will best HELOCs.

Bringing a HELOC otherwise domestic security loan getting care about-functioning anybody need a great deal more comprehensive papers than simply when you have an excellent more conventional field.

Particularly a typically functioning borrower, you will need to confirm you satisfy your own lender’s HELOC requirements and you can feel the means to undertake and you may pay-off the newest debt. To do this, you may need to promote a mix of another:

- Current lender comments (no less than numerous months’ value)-would be individual and you will providers when you have separate profile

- Company and personal tax returns for the past two years

- An announcement from the accountant guaranteeing their business’s fitness

- Business development records and you can evidence of ownership (unless you are a best owner)

Their lender allow you to understand when it demands most earnings recommendations in app techniques. It’s also advisable to be prepared to fill in homeownership and possessions insurance details.

Except that differences in the newest files in it, the house security investment application processes is the same to possess care about-employed and you may usually employed individuals. Just like the house guarantee finance and HELOCs try personal financing, make sure the funds is actually deposited into your private family savings, maybe not a corporate membership.

Recognition and you can money timelines will vary by the bank. Delivering a house equity loan or HELOC isn’t as punctual due to the fact getting a credit card, it are going to be faster than of many loans, for example SBA loans. Enjoy the procedure for taking between fourteen days to a few days from the time your connect with whenever you have access to your money.

Solutions to help you HELOC otherwise home equity loan having a home-functioning debtor

If you’re concerned with your odds of acceptance when you are notice-employed-or if you taken out that loan and you may have been loans Belle Fontaine AL refused-you are able to secure money with your HELOC alternatives:

Cash-out refinance

A finances-aside refinance will provide you with immediate access so you can more income by replacing your mortgage which have a more impressive you to definitely. It is possible to pay off another type of, large financial in exchange for more cash on the wallet. You could potentially often find a lower interest rate with an earnings-away re-finance than just property guarantee financing or HELOC.

House security discussing contract

Property security sharing contract, or household collateral capital, gets a good investment company a fraction of the collateral inturn getting a lump sum. Unlike HELOCs and you will house guarantee funds, property guarantee common agreement isn’t really a variety of financial obligation, it might be more straightforward to be considered.