To buy a home When you have Student education loans: Dont Assist Financial obligation Getting a Dealbreaker

To buy a home When you have Student education loans: Dont Assist Financial obligation Getting a Dealbreaker

December 22, 2024 Comments Off on To buy a home When you have Student education loans: Dont Assist Financial obligation Getting a DealbreakerCongratulations to any or all university graduates online while we stop out of yet another graduation year! Regardless if you are a recently available grad, however at school, or if you completed in years past, chances are you are carrying certain student loan financial obligation. According to the Knowledge Data Step, more than 43 mil Us americans features education loan personal debt, towards the mediocre obligations for every borrower priced at over $37,000 to own government student loans and you will nearly $55,000 to possess private funds.

When you find yourself wishing to pick a property soon, which have this much personal debt dangling more than you can feel like a good genuine hindrance so you can entering the markets. The good news is, there are a number from options to think that will help bring your homeownership aspirations close at hand. Here are some ideas, steps, and information so you can navigate the brand new homebuying techniques when you are carrying education loan personal debt.

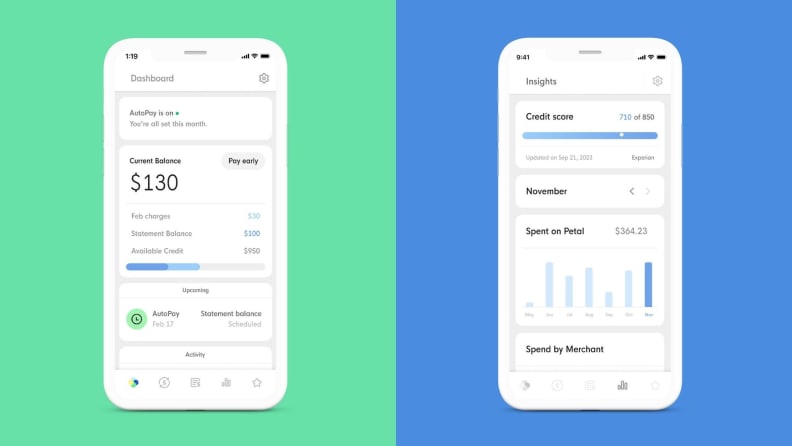

Just like any homebuyer, pick should be to evaluate your financial situation attain a much better understanding of what you are able manage and what your to get means should look like. Start by looking at your credit score, while making an intend to target people borrowing facts , and you can figuring their month-to-month income and you can debt obligations.

Of several earliest-go out people is actually shocked to learn that there are a number out-of mortgage loan advice software that may significantly benefit them and some ones apps are created specifically for borrowers having student loan debt. This type of apps bring various benefits, and all the way down interest levels, faster down-payment amounts, personal debt forgiveness, and.

Within our household condition out of is offered by the Company out-of Construction and Community Invention. From system, being qualified homeowners can be found to 15% of the house price to repay college student obligations into the the type of a 0% interest deferred mortgage no monthly payments, forgivable more five years.

Conditions to have programs similar to this you can take a look a while tricky, and learning an educated channel for your novel things normally be problems. When you are willing to initiate exploring your options, it’s never an awful idea to talk to a talented financing manager. who will help you determine the qualification in addition to potential pros of software like these.

When you got out your college loans, your joined on an agreement about how precisely incase those people fund could be repaid. As with really sorts of fund, your almost certainly have particular alternatives at your disposal having refinancing, restructuring, otherwise altering your college student debt. You may also read the a few of the following tips:

- Income-Determined Repayment (IDR) preparations limit your own monthly payments strongly related your earned earnings. Whenever you are switching your installment words could possibly enhance the much time-identity cost of the mortgage, the reduced monthly payment loans could potentially help to improve the debt-to-earnings (DTI) ratio, making it possible to safe a home loan which works for you.

- Lengthening the phrase of your financing is another means you can even manage to decrease your monthly payments, and thus improving your DTI proportion. Keep in mind however that, also, often expands enough time-label costs by extending their credit more longer.

- Consolidating their fund (when you have several of all of them) can get discover the brand new options for one re-finance the overall overall loans on a diminished rate, prefer a unique financing servicer, otherwise receive much more positive terms.

Keep in mind that all the possibilities in the list above was extremely specific and might feature tradeoffs. Before generally making any transform to the commission agreements or mortgage facts, be sure to consult with a financial mentor and envision all of https://paydayloanalabama.com/pell-city/ the the relevant ramifications.

Conclusion To shop for property if you find yourself writing about student loan obligations get be challenging, however it is from impossible. Into the correct planning and you may recommendations, you can find a knowledgeable options available to you and begin the latest seek out our home you have been fantasizing regarding.

If you’re willing to strike the housing industry however try not to see the place to start, get in touch with our financing officials to see how to enjoy the proper apps and methods in order to ensure it is.

Per year-Round Guide to Family Fix: Monthly Techniques for a pleasurable and you may Suit Domestic

Owning a home contains the obligations regarding regular repair so you’re able to ensure their toughness and you can spirits. Unlike tackling the opportunities at the same time, a much better means is always to split them down into under control monthly avenues. Let us talk about a year-bullet guide to house fix, which have an alternative idea for every month customized towards year, […]

Thanksgiving Appreciation: A good Heartfelt Message from the Lending company

Given that Thanksgiving seasons tips, it is a for you personally to think about the numerous blessings in our lives. In the centre associated with appreciation commonly lays all of our residential property where we find love, safety, and you will love. We want to do not hesitate to generally share our heartfelt gratitude towards chance to help those people family […]

Making preparations Your home to have Cold weather: Very important Measures for a comfortable Seasons

While the 3rd times of November rolls around, it’s the perfect time first off contemplating getting ready your property toward cool days in the future. Cold weather can be volatile, therefore the final thing you want is to be trapped regarding shield from the shedding temperatures and you may negative climate. To help you get able into […]