Understanding Stock Market Basics

Understanding Stock Market Basics

June 9, 2022 Comments Off on Understanding Stock Market BasicsContents

They can https://forex-trend.net/ higher yields than many traditional fixed income investments, but they come with different risks. However, if you do realize a gain by selling the stock, you’ll owe capital gains taxes on it. How long you hold the stock will determine how it’s taxed. If you buy and sell the asset within a year, it will fall under short-term capital gains and will be taxed at your regular income tax rate. If you sell after you’ve held the asset a year, then you’ll pay the long-term capital gains rate, which is usually lower.

Frequently, events in the economy or the business environment can affect an entire industry. For example, it’s possible that high gas prices might lower the profits of transportation and delivery companies. DSPs and DRIPs are usually administered for the company by a third party known as a shareholder services company or stock transfer agent. The issuing company may pay dividends, but it doesn’t have to. If it does, the amount of the dividend isn’t guaranteed, and the company can cut the amount of the dividend or eliminate it altogether. On the other hand, investing in a single company exposes you to a more significant set of risks.

How To Invest In Stocks: Understanding Equity ETFs

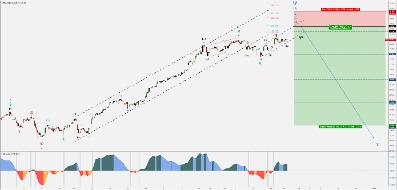

As I mentioned above, the best way to invest is to do so on your own. Most professional investors (we’re talking 96%) don’t beat the market. Investors buy stocks when they think the company’s share price will increase and sell stocks when they think the company’s share price will go down. After a company is public, its stock price is set by basic supply and demand. The more individual investors who want to purchase a piece of the company, the higher its stock price goes and vice versa. When a company goes public its initial stock price is set by a bank based on the company’s value and demand from institutional investors.

You borrow the shares from a lender (like a broker-dealer) and sell in the open market with proceeds from the sale credited to your account. Eventually you must purchase the same number of shares borrowed and return them to the lender – this is referred to as closing out or covering the short-sale position. New investors need to be aware that buying and selling stocks frequently can get expensive.

The https://topforexnews.org/ “secondary market” is a bit misleading, since this is the market where the overwhelming majority of stock trading occurs day to day. This content is general in nature and does not constitute legal, tax, accounting, financial or investment advice. You are encouraged to consult with competent legal, tax, accounting, financial or investment professionals based on your specific circumstances. Corrections are generally short-lived, lasting on average three to four months, while bull and bear markets can last for longer periods of time. A correction can be a precursor to a bear market if stock prices continue to fall. Some companies allow you to buy or sell their stock directly through them without using a broker.

What are stocks?

There are many ways to build a diversified stock portfolio, depending on whether you want to be an active or passive investor. An active investor will research stocks to find a collection of at least 10 companies across various industries that they believe will be winning investments over the long term. Meanwhile, passive investors let others do that work for them.

Type the phrase in google “NameofStock Share Price”, and a price chart will appear. Read the price movements of the last few days, months, and years, since inception. A rising trend shows growth, and a falling trend shows weakness. Open the Stock Engine and check the stock’s Overall Score and Intrinsic Value to judge its fundamentals.

- DTTW™ is proud to be the lead sponsor of TraderTV.LIVE™, the fastest-growing day trading channel on YouTube.

- This means that the general public doesn’t have access to them so ownership is limited to a small group of employees or internal company investors.

- Dividends aren’t guaranteed, and not all companies offer them.

- We do not include the universe of companies or financial offers that may be available to you.

Do not rely upon the information provided in this content when making decisions regarding financial or legal matters without first consulting with a qualified, licensed professional. Investing remains one of the four cornerstones of a strong financial foundation. And, learning how to do it can be both achievable and rewarding. The NYSE eventually merged with Euronext, which was formed in 2000 through the merger of the Brussels, Amsterdam, and Paris exchanges.

Prices for an entire sector could be driven up if a leading company in that sector releases a stronger than anticipated quarterly earnings report. When a swing happens, you could lose money or get a boost in your portfolio, depending on which way it goes. When you purchase stock in a company, you can choose to purchase one tiny piece or many tiny pieces. The number of individual stocks you buy is also called your “share” or shares. When the stock price goes up, the value of your shares increases and so does the return on your investment.

But building a diversified portfolio of individual stocks takes a lot of time, patience and research. The alternative is a mutual fund, the aforementioned exchange-traded fund or an index fund. These hold a basket of investments, so you’re automatically diversified. An S&P 500 index fund, for example, would aim to mirror the performance of the S&P 500 by investing in the 500 companies in that index.

A broad market index, such as the S&P 500 or the Dow is a good representation of how the stock market is trending as a whole. Among the various major stock exchanges, the New York Stock Exchange is the most famous and the largest home of stock trading. Many of the largest companies in the world choose to list their shares on the New York Stock Exchange. Sometimes an entire industry might be in the midst of an exciting period of innovation and expansion and becomes popular with investors. Other times that same industry could be stagnant and have little investor appeal.

If you’re looking for a guaranteed return, perhaps a high-yield CD might be better. Investors make virtual trades as if they were investing with real money. Through this process, simulator users have the opportunity to learn about investing—and to experience the consequences of their virtual investment decisions—without putting their own money on the line. Some simulators even allow users to compete against other participants, providing an additional incentive to invest thoughtfully.

Classes of Stock

In this section, I go through the different options, explain what they are and decide what is best for you. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Its broker-dealer subsidiary, Charles Schwab & Co., Inc. , offers investment services and products, including Schwab brokerage accounts. Its banking subsidiary, Charles Schwab Bank, SSB , provides deposit and lending services and products. Access to Electronic Services may be limited or unavailable during periods of peak demand, market volatility, systems upgrade, maintenance, or for other reasons. Yes, when you sell shares of a stock that you do not own, this is referred to as a short sale.

Get a weekly email of our pros’ current thinking about financial markets, investing strategies, and personal finance. Responsible investment emphasizes and requires a long-term horizon on the basis of fundamental analysis only, avoiding hazards in the expected return of the investment. Socially responsible investing is another investment preference. Exchanges also act as the clearinghouse for each transaction, meaning that they collect and deliver the shares, and guarantee payment to the seller of a security. This eliminates the risk to an individual buyer or seller that the counterparty could default on the transaction. A potential buyer bids a specific price for a stock, and a potential seller asks a specific price for the same stock.

Plans usually offer a variety of stock and bond mutual funds. The market refers to companies selling their stock—a piece of ownership in the business—to investors. It’s a way for companies to raise money without borrowing. Dividends are a portion of the company’s earnings paid to shareholders.

Deciding How Much Money To Start With

The stock market is like a swap meet, auction house, and shopping mall all rolled into one. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. You tell your broker what stock you want to buy and how many shares you want. If you throw all of your money into one company, you’re banking on success that can quickly be halted by regulatory issues, poor leadership or an E.

By building a https://en.forexbrokerslist.site/ of long-term investments through investing in the stock market. The fund may own bonds from hundreds of issuers and sell them before the maturity date. Unlike an individual bond you hold to maturity, bond funds don’t promise the return of your original investment. Found in many workplace retirement plans, target-date mutual funds are designed for people who want to put their investing on autopilot. A share represents a unit of ownership in the company that issues it. If you invest $500 in a stock that’s selling shares at $10 each, then you own 50 shares of that company’s stock.