What are the Most significant Differences when considering FHA and you may Antique Fund?

What are the Most significant Differences when considering FHA and you may Antique Fund?

January 12, 2025 Comments Off on What are the Most significant Differences when considering FHA and you may Antique Fund?- Blogged towards the

- 5 minute loans in Delta realize

Amy Pawlukiewicz is actually a writer and you can publisher with well over fifteen years of expertise in her job. She has a b.Good. in English out-of Kenyon College or university and you can already stays in Los angeles.

If you find yourself a first-date homebuyer, you have enough conclusion and then make, also what kind of financing to choose. You have got read you to definitely FHA money are good options for first-time homebuyers, however, what makes you to definitely? What is the difference in an enthusiastic FHA and you may a conventional loan?

Well, FHA fund has several gurus getting basic-big date homebuyers you to definitely traditional fund never. You can aquire an FHA loan having a reduced credit history, like.

But not, traditional finance have their selection of experts, like the ability to treat individual mortgage insurance if you have a reduced down-payment. When you find yourself torn between the two type of mortgages, here you will find the larger differences when considering a keen FHA and you can a conventional mortgage.

Tell us somewhat regarding your arrangements (what your location is looking to buy just in case we should create a purchase) and we will hook you which have top-ranked consumer’s agencies near you. It takes only a few minutes, and it’s really 100 % free.

FHA loans are insured by the FHA; antique loans are not

FHA financing is fund that are backed by the fresh new Federal Homes Government, plus they should be provided of the a keen FHA-acknowledged financial.

Conventional finance are not backed by brand new FHA but they are covered because of the individual loan providers and that they may be given by the a good large number of loan providers.

What does it indicate in the event that FHA assures a loan? In the event the client non-payments on home and domestic forecloses, the lending company is shielded from a particular level of losings by the fresh FHA. This more covering out-of shelter prompts lenders to extend money so you can borrowers that have lower down costs and credit scores, broadening the opportunity of homeownership in order to consumers which can if you don’t be ineligible around conventional conventional financing.

Credit ratings

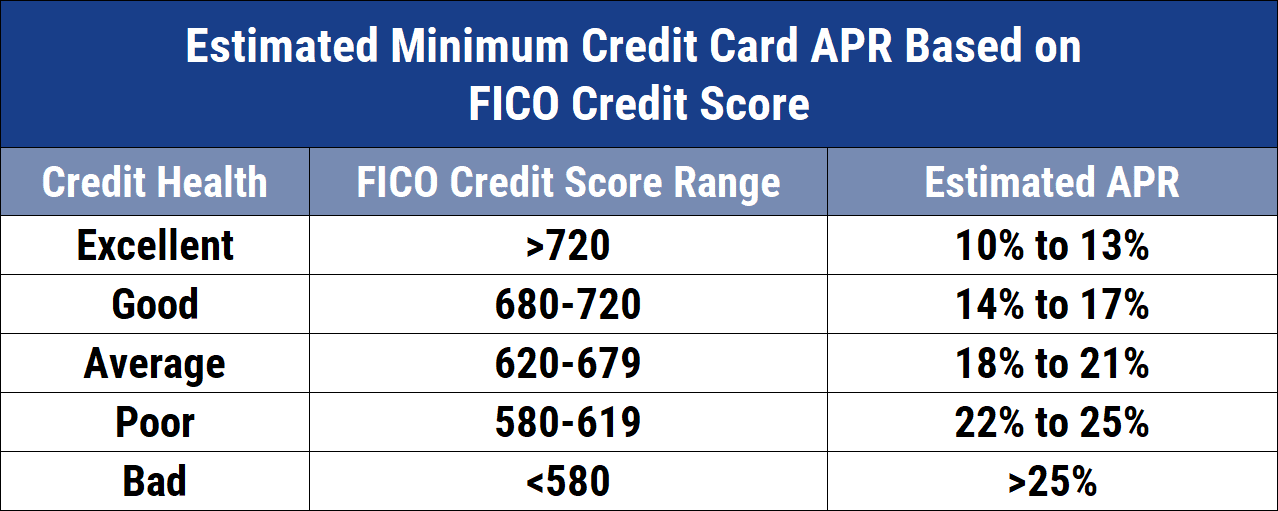

Antique funds generally want a credit rating of 620 or even more, if you’re an FHA financing will be secured that have a credit score as low as five-hundred for those who have an excellent 10% downpayment, or only 580 when you have an excellent step three.5% deposit. With FHA finance, usually the credit history is a little bit less. They are so much more flexible, says Phoenix-situated representative Andrew Monaghan, who’s got 19 numerous years of sense position buyers within their dream home. It includes another type of chance of homeownership.

Off repayments

Whenever you are traditional financing usually need a top credit score than just an FHA loan, if your credit rating was large, you might still safe a conventional financing with a beneficial step 3% down payment. Although not, extremely traditional loans normally need a down payment off between 5% and you may 20%.

The minimum downpayment for an FHA mortgage are step three.5%, and come up with FHA finance significantly more available to basic-time homeowners exactly who may not have much protected to have an advance payment.

And additionally, to own FHA money, you can find down payment advice programs readily available that will help ease the responsibility regarding creating a down-payment. FHA money enable 100% of the advance payment add up to getting a present, whenever you are conventional financing only enable it to be part of the downpayment to-be a present.

Financial insurance rates, individual or else

Financial insurance policy is insurance one loan providers need without a doubt money one the financial institution takes into account a great deal more risky. This new acronym PMI stands for individual home loan insurance rates, that’s granted to have conventional fund; government-backed funds also require financial insurance rates, but you to definitely insurance policy is coming from the FHA, not a private business.