Whenever should you decide acquire from the 401(k)? Have fun with ‘as a last resorts, Fidelity agent warns

Whenever should you decide acquire from the 401(k)? Have fun with ‘as a last resorts, Fidelity agent warns

January 11, 2025 Comments Off on Whenever should you decide acquire from the 401(k)? Have fun with ‘as a last resorts, Fidelity agent warnsAn increasing number of People in america was taking out fully hardship’ withdrawals from their 401(k)s to cover disaster will set you back

- Statements

Borrowing from the bank from the 401(k) are going to be put just like the a last resort’: Leanna Devinney

With a growing amount of Americans tapping into its 401(k)s to fund disaster will set you back, many workers struggling with large rising prices is curious when’s the brand new right time in order to borrow from their senior years coupons.

“The old-age savings are for our old age or those individuals a lot of time-identity goals we has, as soon as our company is bringing a withdrawal or even a loan out of it, however, targeting withdrawals, we’re her latest blog affecting our very own upcoming requirements,” Devinney told Fox Reports Digital to your Thursday. “Therefore we carry out have to cure the latest difficulty distributions just like the good last resort.”

As Innovative Classification stated that dos.8% of experts doing workplace-paid 401(k) arrangements produced a so-entitled “hardship” withdrawal inside 2022, Devinney detailed you to Fidelity spotted dos.1% of their customers delivering a 401(k) withdrawal otherwise mortgage.

“We watched costs from the supermarket increasing and the energy pump when you find yourself there, today our company is enjoying using increase. And another region was just the latest savings in the industry, i watched extreme volatility and many thought secured,” Devinney told you. “And therefore that would be two aspects of this new factor in in need of the latest withdrawals.”

Making use of your 401(k) deals to pay for a crisis bills are going to be used while the a good “last resort,” based on Fidelity Trader Facilities branch frontrunner Leanna Devinney. (iStock)

Taking right out a pension loan otherwise withdrawal sooner or later has an effect on your upcoming requirements, the fresh adviser contended whenever you are listing, “for the majority of, advancing years coupons was also addressed because crisis coupons. When an urgent situation does appear, if you don’t have other membership to access while you prefer to consult with your retirement account, that is as soon as we find it happen.”

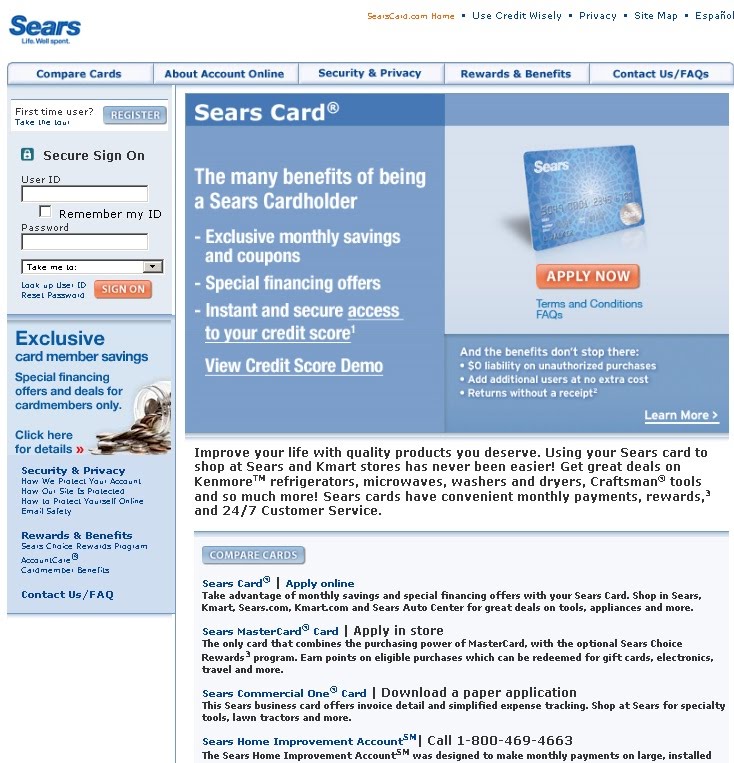

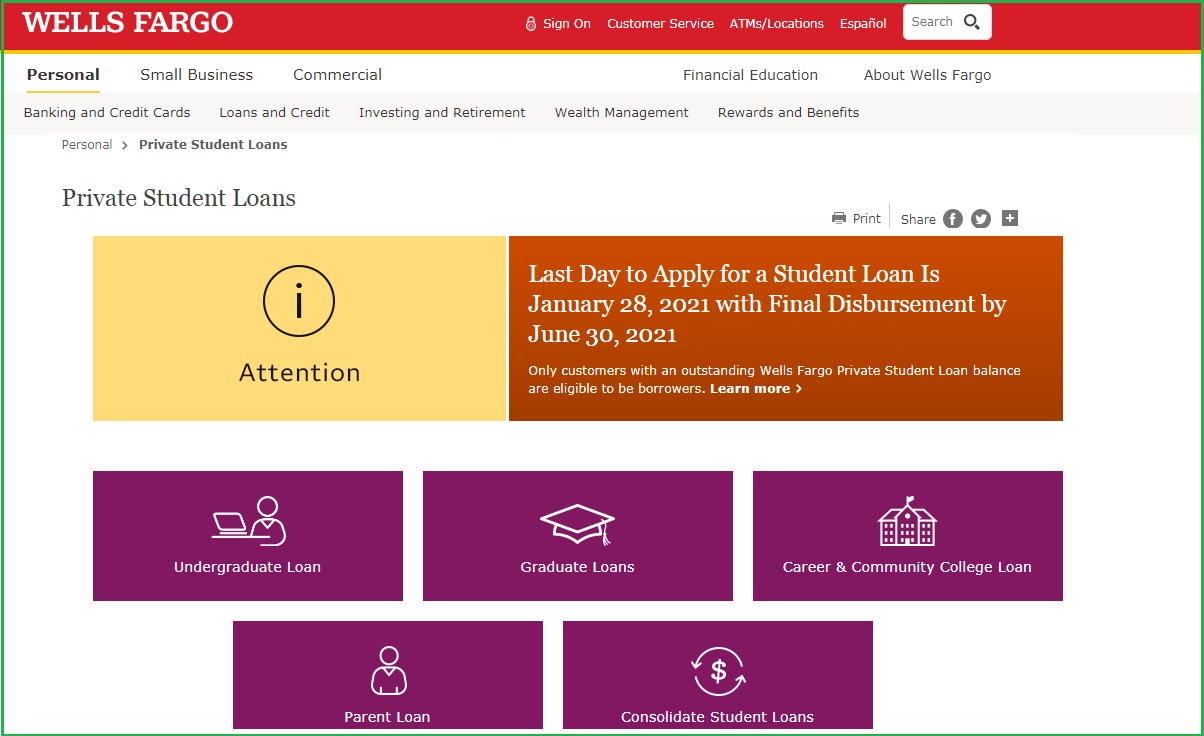

Emergency objectives tend to be medical expenses, risk of foreclosure, tuition otherwise figuratively speaking for you or your loved ones, and also funeral service costs all qualify for difficulty distributions. When deciding how to pay for the costs, Devinney provided a great “hierarchy” of disaster saving options.

“When you yourself have an economy or bank account in order to exhaust first, our signal is really to own 3 to 6 days away from their costs place in an emergency bank account,” this new Fidelity department leader said. “For almost all, that’s difficult. So we at the very least should make sure you may have a boundary off $step one,000 just as a kick off point.”

In the case you to a lot more discounts commonly possible, Devinney advised exploring a reduced-desire mastercard, family guarantee credit line or unsecured loans.

Home offers was a trillion less than where they were: Stephanie Pomboy

Macro Mavens creator Stephanie Pomboy discusses the state of home preserving together with comments from JP Morgan Ceo towards the Fox Providers This evening.’

“Once more, speaking of personal debt, but it’s some most readily useful obligations because when you bring an adversity withdrawal, you happen to be subject to investing you are able to penalties to possess an earlier withdrawal, including taxation. Therefore exploring people options is vital,” she said.

For Americans trying spend less in the present financial ecosystem, Devinney required which have a specific economic goal at heart.

“Can it be a crisis finance? Is-it attempting to pick a home from inside the 10 years? Can it be attempting to carry on that great travel? Is it advancing years 29-including decades out? Begin by the target,” she told. “Whenever we feel the purpose, i upcoming get on how we get to the purpose.”

Us americans try purchasing from coupons and you can relying on debt: Nela Richardson

ADP chief economist Nela Richardson and you may McClellan markets statement publisher Tom McClellan take a closer look on state of your own You.S. savings on ‘Making Money.’

“If it’s an emergency funds, we start with that number and then we create an idea that, week on week otherwise month shortly after week, we have been contributing a specific amount from our salary on the an economy membership to get to one goal we have,” Devinney explained. “I find activities eg, ‘set it and tend to forget it,’ automatic contributions, such things as which help, after which allow yourself people monetary checkups. Remain proactively examining when you look at the and you may function those people other kilometer indicators.”

“Indeed, when you have an employer-paid bundle, we need to subscribe to pension coupons and just have the team match up. That’s section of it,” she continued. “But really means a goal to build one to savings colony eggs, when a life experiences happens, in the event the an emergency goes, you aren’t likely to the enough time-term senior years money to utilize you to towards the emergency therefore go to your offers.”